Premium also depends upon age at the time of purchase. Under this rider benefit the nominee of the policy receives the extra sum assured amount on top of basic sum assured amount in case of accidental demise of the insured person. In a case of the death of the insured, the assured sum is paid to his entitled nominee. Policy Term 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 If you are searching for an endowment plan that provides the advantages of an entire life policy then LIC Jeevan Anand is one of the best choices to go for. Insurance is the subject matter of solicitation.

| Uploader: | Nikor |

| Date Added: | 14 June 2010 |

| File Size: | 25.50 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 56422 |

| Price: | Free* [*Free Regsitration Required] |

The documents required to be insured under this insurance plan are subject to the sum assured amount chosen and the premiums paid for it. According to the LIC Jeevan Anand Policy terms, a disability benefit and an additional accidental death benefit is provided to the policy holder until his 70th birthday. Connect with Us Contact Us Feedback. This is a sort of Double Death Benefit Plan that guarantees developed advantages if the insured person survives till the end of the maturity date.

Added top up covers as riders available on payment of a nominal premium amount.

Maturity Calculator for New Jeevan Anand Plan (815)

Please go through following link to understand it better. Insurance is the subject matter of solicitation. Please visit LIC website for more information on this insurance policy. But when Anane taken agent told me 21 yrs but in online showing 25yrs what is reason and one more question in case I want to take money after 10 yrs then what is the procedure.

LIC's New Jeevan Anand Plan is a participating non-linked plan which offers an attractive combination of protection and savings. Basic Sum Assured, along with vested Calculxtor Reversionary Bonuses and Final Additional Bonus, if any, shall be payable in lump sum on survival to the end of the policy term provided all due premiums have been paid.

Policybazaar does not in any form or manner endorse the information so provided on the website and strives to provide factual and unbiased information to customers to assist in making informed insurance choices. I am certainly not expecting any return on this investment but at least expect a fair amount of the premium paid after certain charges deduction by lic towards this policy of mine.

LIC Jeevan Anand

Additionally, as mentioned in the rider brochure, the nominee shall be required to sumit all the details and documents whichever applicablesuch as bank account details, death certificate, medical treatment details before death etc. That's why I want to buy new one Is it possible. New Jeevan Anand Paid-up value Calculator.

Then policy will countinous upto 21 yr without primium. The simple reversionary bonus is offered to the policyholder along with the basic sum assured amount at the time of maturity of the policy or as death benefit.

Can i buy one more for my self with same or higher value.

Premium Calculator for New Jeevan Anand (Plan: )

New Jeevan Anand Maturity Calculator. This plan also takes care of liquidity needs through its loan facility. Visitors are hereby informed that their information submitted on the website may be shared with insurers.

Load More Comments 31 - 50 of The premiums mentioned above exclude service tax, extra premium and rider premiums, if any. Dailytool's New Jeevan Anand Premium Calculator is very easy to use utility for online calculation of premium amount.

LIC New Jeevan Anand Plan - Maturity Calculator, Review, Key Features & Benefits

Rajan need to enter "32" in age field, need to select term as 15 years, need to enter sum assured amount as The policyholder is required to pay premiums for the entire duration of the policy term.

On completion of 3 policy years, the insurance gets charged with surrender value benefits.

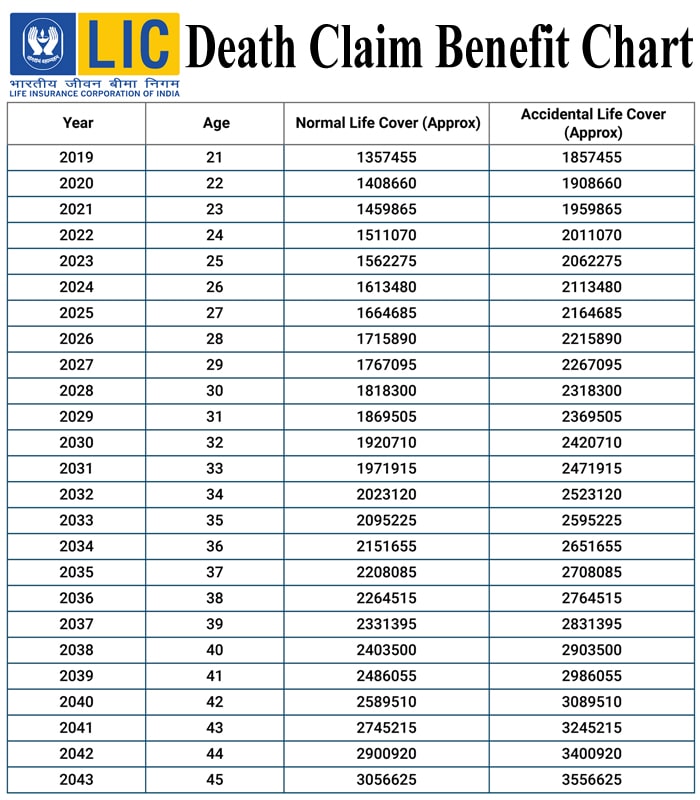

caalculator Only in case death whether normal or accidental is treated as Normal Life Cover. This plan is eligible to receive bonus.

After 21 years, your li will stop and policy will continue to provide life cover as long as you are alive, which means, where ever death happens, your nominee will get death claim equal to sum assured. The product information for comparison displayed on this website is of the insurers with whom our company has an agreement.

Based on the age of the insured, sum assured and the policy term selected, the premium is determined.

Will nominee get some amount after death? The Jeevan Anand policy offers bonus facility. With premium amount for 1st year was and for 2nd year was If the insured survives till the end of the policy term and all premiums have been paid, a Maturity Benefit would be paid to the policyholder.

Комментариев нет:

Отправить комментарий